Housing values end the year 22.1% higher with the pace of gains continuing to soften as multi-speed conditions emerge

Australian housing values were 1.0% higher in December, slowing from a 1.3% rise in November, continuing the softening trend in the monthly growth rate that has been evident since the national index moved through a cyclical high of 2.8% growth in March 2021.

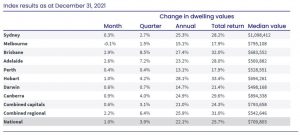

As dwelling value appreciation slows, conditions are becoming more diverse amongst the capital cities and regional areas of Australia. Across the capitals, the monthly change ranged from a 0.1% fall in Melbourne housing values (the first month-on-month fall in Melbourne housing values since October 2020), through to a 2.9% surge in Brisbane dwelling values.

Brisbane and Adelaide, along with regional Queensland, are the only broad regions where there is no evidence of value growth slowing just yet, with the monthly rate of growth reaching a new cyclical high in December.

CoreLogic’s Research Director Tim Lawless said: “These regions show less of an affordability challenge relative to the larger capitals, as well as better support for housing demand with Queensland in particular showing strong interstate migration. Additionally, we haven’t seen the same level of supply response seen in other regions, with the trend in advertised supply remaining well below average in these markets.”

On the other end of the spectrum, momentum has slowed quite sharply in Melbourne and Sydney dwelling markets, with both cities recording the softest monthly reading since October 2020.

“A surge in freshly advertised listings through December has been a key factor in taking some heat out of the Melbourne and Sydney housing markets, along with some demand headwinds caused by significant affordability constraints and negative interstate migration,” Mr Lawless said.

Regional Australian housing values have seen some renewed momentum with a monthly rise of 2.2%, the highest in nine months. Regional Queensland was the clear standout across the rest-of-state markets in December, with housing values up 2.4%, however over the year the strongest regional markets have been in New South Wales (29.8%) and Tasmania (29.5%).

The most popular regional markets have seen housing values rise more than 30% over the calendar year, with the Southern Highlands and Shoalhaven recording the highest annual rise in home values at 37.7%, followed by Queensland’s Sunshine Coast at 33.7%.

After leading the upswing, it is clear the upper quartile of the housing market is now leading the slowdown. Across the combined capitals, upper quartile dwelling values were up 2.6% in the December quarter compared with a 3.7% rise across the lower quartile and broad middle of the market.

“We have seen this trend in previous growth cycles, where more expensive housing markets have shown greater levels of volatility; housing values tend to rise more through the upswing but record a larger decline through the down phase of the cycle,” Mr Lawless said.

A two-speed market is emerging across the state capitals. While the pace of capital gains has been easing in Sydney, Melbourne and Perth, conditions across the Brisbane and Adelaide housing markets have gathered momentum.

The slowing trend in Sydney and Melbourne can be explained by a bigger deposit hurdle caused by higher housing prices alongside low income growth, as well as a recent surge in advertised inventory levels and weak demographic trends. Slower conditions across the Perth housing market may be more attributable to the disruption to interstate migration caused by extended closed state borders which has had a negative impact on housing demand. In Brisbane and Adelaide, housing affordability is less challenging, advertised stock levels remain remarkably low and demographic trends continue to support housing demand.

Regional markets are seeing renewed momentum in the pace of value growth. Since March 2020, housing values across regional Australia are up 32.0% compared to the 20.0% lift in values seen across the combined capitals.

The quarterly pace of growth in regional dwelling values rebounded through the December quarter, in contrast to slowing momentum across the capital city market. Regional dwelling values were up 6.4% in the three months to December, compared to the 5.1% rise recorded in the September quarter. This potentially reflects a new wave of demand as buyers exited the extended lockdowns in Sydney and Melbourne.

Inventory is low across regional Australia, with advertised stock levels finishing the year 35.9% below the five-year average. This compares to combined capital cities seeing stock 14.2% below the five-year average. It is likely regional markets, especially those with lifestyle appeal, will continue to benefit from higher demand as remote working policies are more normalised, and demand for holiday homes remains strong amid continued international border restrictions. However, as interest rates begin to bottom out, and affordability constraints extend to regional markets, these housing markets may also move into a downswing phase over the course of 2022.

Advertised inventory finished the year 24.7% below the five-year average. A shortage of listings has been a feature of the housing market through the COVID period to-date, creating a sense of urgency amongst buyers. The good news for prospective home owners is that total listings have started to rise through the final quarter of the year as ‘fresh’ listings have trended above average in some regions.

Nationally, the number of new listings added to the Australian housing market through December was 21.4% above the five-year average, demonstrating strong vendor confidence amidst quick selling times and high auction clearance rates. As new listings surged higher through spring and early summer, buyers have benefitted from more choice and reduced urgency.

This confidence has not been universal, with listings trends varying from city to city. Melbourne was the only city to finish the year with inventory levels above the five-year average, while Sydney listings were only 3.9% below average. At the other end of the scale, Brisbane and Adelaide’s advertised supply remains around 35% below the five-year average.

“The number of homes available to purchase has been a key factor underlying the trend in housing values. Cities where advertised stock levels are above average or close to normal, such as Melbourne and Sydney, have shown a more obvious slow down relative to cities with persistently low advertised supply, like Brisbane and Adelaide,” Mr Lawless said.

Strong housing demand has been another factor driving housing prices higher. While stock levels have generally been low, the total number of home sales in 2021 was approximately 40% above the decade average. CoreLogic estimates there were approximately 653,000 house and unit settlements over the calendar year, the highest number of annual sales on record.

“Such a significant mismatch between available housing supply and the level of demand is a fundamental reason why housing prices have risen so sharply over the year. As stock levels normalise and affordability constraints along with tighter credit conditions drag down demand, it’s reasonable to expect growth conditions will be more subdued in 2022,” Mr Lawless said.

Nationally, dwelling rents increased by 9.4% over the 2021 calendar year; the largest annual increase since the 12 months ending January 2008. Unit rents were up 7.5% over the year compared to the 10.1% lift recorded in house rents.

Rental growth trends across the unit sector have generally been milder than houses, with unit rentals being disproportionately affected by stalled overseas migration as well as domestic rental preferences shifting away from higher density options through the pandemic. However, these trends are starting to change as rental affordability diverts demand back towards the unit sector.

“In Melbourne, where unit rents fell by -8.5% between March 2020 and May 2021, higher density rental markets are now recording a faster rate of growth than houses, with Melbourne unit rents recording a 1.6% quarterly increase compared to the 0.9% rise seen in house rents,” Mr Lawless said.

The tightest capital city rental market over the year has been Darwin, where dwelling rents rose 15.2%. Conditions have eased a little over the second half of the year, with annual rental growth moving through a peak of 22.3% over the 12 months ending August. Although rents have surged across the northern most capital, Darwin’s rental index remains 7.6% below its 2014 peak; a legacy of the 26.3% decline in rents recorded between March 2014 and December 2019.

With national housing values recording an annual rise of 22.1% compared with a 9.4% rise in rents, rental yields have decreased as a natural consequence. Gross rental yields fell to a new record low across Australia, reaching 3.2% in December. The lowest yields, by some margin, remain in Sydney (2.4%) and Melbourne (2.7%), however, with the exception of Perth and Darwin, every capital city is recording record low yields.

What’s ahead in 2022

2021 has been an unprecedented year for Australian housing markets, but 2022 is likely to see a further easing in the pace of capital gains.

The number of home sales reached new record highs against a backdrop of below average listings and stalled overseas migration. The large majority of housing demand has originated from domestic sources, fueled by record low mortgage rates and an accumulation of pent-up demand from prior years, when housing turnover reached record lows.

As international borders re-open, rental demand is likely to be the main beneficiary, rather than home buying demand, especially across the inner city rental precincts popular with students and visitors.

The final months of 2021 saw housing values move through the fastest rate of annual growth since the late 1980s at a time when wages and household incomes hardly moved. The juxtaposition of higher housing values against low income growth has resulted in higher barriers to entry: it is becoming increasingly harder to raise a deposit and fund transactional costs such as stamp duty. It is likely housing affordability challenges will progressively weigh on housing demand over the year ahead.

Considering the worsening housing affordability situation, and with a federal election to be held this year, home ownership and housing affordability are likely to be hot political topics across the major parties.

Sellers have held the upper hand at the negotiation table but buyers are starting to regain some leverage. With demand outweighing advertised supply, vendors have been empowered. Nationally, homes were selling in 23 days early in 2021 with minimal negotiation on advertised prices, auction clearance rates were holding in the high 70% to early 80% range across the major auction markets and buyers were often experiencing a nasty case of FOMO.

The tides have started to turn however, as new listings increased in the later part of the year. The average time on market is beginning to increase, while auction clearance rates have trended down. The combined capital cities clearance rate hit a record high 83.2% for the week ending October 3rd as COVID restrictions eased across the major capitals, but averaged just 63.8% through December.

As new listings continue to rise, and demand eases, we should see advertised stock return to more normal levels, providing buyers with some renewed leverage. Homes are not likely to sell as rapidly and clearance rates are more likely to hold around average levels as housing conditions normalise.

COVID remains the biggest wildcard, especially given surging case numbers related to the Omicron strain. A return to restrictive policies, especially those that prohibit movements or home inspections, would result in a new phase of temporary disruption to transaction activity. However, such a scenario may also prolong expansive monetary policy and low interest rates, which helped sustain housing demand through 2021.

An early lift in interest rates and tighter credit policies are the other downside risks for housing. An early lift in the cash rate implies the economy has improved enough to tighten monetary policy, however housing markets are likely to be sensitive to any increase in the cost of debt. Similarly, a further tightening in housing credit policies would also act as a dampener on housing activity.

A more diverse performance is on the cards. The second half of 2021 highlighted a growing disparity between the performance of different capital city and regional housing markets. Trends in labour markets, demographic patterns, supply levels and affordability will all play a key role in how housing markets perform around the country.

Although there are some headwinds building for the housing market, we expect national housing values will continue to rise in the short term. Even if interest rates rise earlier than expected, it is likely to be a gradual process. The cost of debt is likely to remain well below long term averages, continuing to support housing demand for an extended period of time.

Corelogic reports